Commercial loans are a cornerstone of business financing, providing the capital necessary for expansion, operations, and investments. Whether you’re looking to purchase real estate, upgrade equipment, or manage cash flow, a commercial loan can be the key to achieving your business goals. However, understanding how these loans work and how to navigate the application process is essential for making informed financial decisions. This guide offers a comprehensive overview of commercial loans, their benefits, challenges, and the steps to secure the right financing for your business.

What Are Commercial Loans?

Commercial loans are financial products designed specifically for businesses rather than individuals. They provide funding for various purposes, such as acquiring property, purchasing equipment, or covering operational expenses. Unlike personal loans, commercial loans are tailored to meet the unique needs of businesses, with terms and structures that align with their financial dynamics.

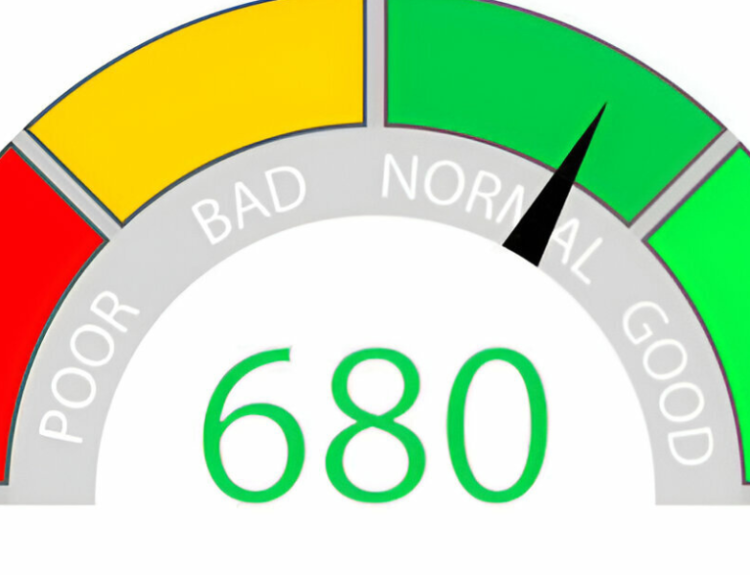

The amount borrowed, interest rates, and repayment terms depend on factors such as the business’s financial health, creditworthiness, and the lender’s policies. Some loans are secured, requiring collateral such as property or equipment, while others are unsecured, relying on the borrower’s credit profile and business performance.

Types of Commercial Loans

There are several types of commercial loans, each designed to address specific business needs. Real estate loans are used to purchase, build, or renovate commercial properties, while equipment loans finance the acquisition of machinery or technology. Working capital loans provide short-term funding to manage cash flow and operational expenses, ensuring the business can meet its obligations during periods of reduced revenue.

Lines of credit are another common option, offering businesses flexible access to funds that can be drawn upon as needed. These are particularly useful for managing seasonal fluctuations or unexpected expenses. Additionally, Small Business Administration (SBA) loans, backed by the government, provide favorable terms for small businesses, often with lower interest rates and longer repayment periods.

Benefits of Commercial Loans

One of the primary benefits of commercial loans is their ability to provide immediate access to capital, enabling businesses to seize growth opportunities or address financial challenges. By spreading costs over time, these loans allow businesses to invest in assets or initiatives without depleting their cash reserves.

Commercial loans also offer tailored solutions to meet the unique needs of businesses. Whether you’re expanding operations, launching a new product line, or acquiring a competitor, the right loan can be structured to align with your specific goals. This flexibility makes commercial loans a versatile tool for supporting business growth.

Moreover, using a commercial loan to finance significant investments can improve cash flow and liquidity. Instead of paying large sums upfront, businesses can manage predictable monthly payments, freeing up resources for other priorities. This strategic use of debt can enhance financial stability and operational efficiency.

Challenges and Risks

While commercial loans provide significant benefits, they also come with challenges and risks. One of the most notable is the requirement for collateral in many loan types. Businesses must pledge valuable assets, such as real estate or equipment, to secure the loan. If the business fails to meet repayment obligations, these assets could be forfeited.

Another challenge is the rigorous approval process. Lenders assess factors such as credit history, financial statements, and business plans to determine eligibility. For startups or businesses with limited credit history, meeting these requirements can be difficult. Additionally, interest rates on commercial loans can vary widely based on market conditions and the borrower’s risk profile, potentially increasing the overall cost of borrowing.

Repayment terms also demand careful consideration. While longer terms reduce monthly payments, they increase the total interest paid over time. Conversely, shorter terms result in higher monthly payments but lower overall costs. Striking the right balance requires a thorough understanding of your business’s cash flow and financial capacity.

Steps to Securing a Commercial Loan

Securing a commercial loan involves a series of steps that require preparation and attention to detail. The first step is assessing your business’s financial health. Understanding your revenue, expenses, and profitability provides a clear picture of your borrowing capacity and repayment ability.

Next, identify the purpose of the loan and the amount needed. Having a clear plan for how the funds will be used strengthens your loan application and demonstrates to lenders that the financing will support measurable business objectives. This could include purchasing equipment, expanding into new markets, or improving infrastructure.

Selecting the right lender is another critical step. Research banks, credit unions, and alternative lenders to find one that offers terms and conditions aligned with your needs. Some lenders specialize in certain industries or loan types, providing tailored solutions for specific business requirements.

Once you’ve chosen a lender, prepare the necessary documentation. This typically includes financial statements, tax returns, a business plan, and details about the collateral being offered. Comprehensive and accurate documentation demonstrates your professionalism and improves your chances of approval.

Submitting your application is followed by a review process, during which the lender evaluates your financial profile and business potential. Be prepared to answer questions, provide additional information, or clarify aspects of your application. Once approved, carefully review the loan agreement to ensure you understand the terms and conditions before signing.

Maximizing the Benefits of a Commercial Loan

To maximize the benefits of a commercial loan, it’s essential to use the funds strategically. Focus on investments that generate a return, such as expanding operations, acquiring assets, or entering new markets. This ensures that the loan contributes directly to business growth and profitability.

Managing the loan responsibly is equally important. Make payments on time to maintain a strong credit profile and avoid penalties. Monitoring your cash flow and adjusting budgets as needed helps ensure that the loan does not strain your financial resources.

Building a strong relationship with your lender can also be advantageous. Open communication and a history of reliable repayment can lead to better terms for future borrowing. Some lenders offer additional services, such as financial advice or access to industry networks, which can further support your business.

Conclusion: Leveraging Commercial Loans for Growth

Commercial loans are a powerful tool for businesses, providing the capital needed to achieve growth, stability, and innovation. By understanding the types of loans available, preparing thoroughly, and working with the right lender, business owners can secure financing that aligns with their goals.

While commercial loans come with challenges, careful planning and strategic use of funds can mitigate risks and maximize benefits. Whether you’re expanding your operations, upgrading your equipment, or managing cash flow, a commercial loan can be the catalyst that drives your business forward. With the right approach, you can leverage this financial resource to unlock opportunities and build a stronger, more successful future for your business.