Interest rates play a crucial role in determining the affordability and overall cost of commercial loans. For business owners, understanding how interest rates work and how they impact loan terms is essential for making informed financial decisions. Whether you’re financing a new project, expanding operations, or managing cash flow, the interest rate on your loan can significantly influence your repayment obligations and long-term financial health.

Understanding Interest Rates

Interest rates represent the cost of borrowing money from a lender. They are expressed as a percentage of the loan amount and are applied over the loan term. For commercial loans, interest rates can be either fixed or variable, each with its own implications.

Fixed interest rates remain constant throughout the life of the loan, providing predictability in repayment amounts. This stability is beneficial for businesses that prefer consistent monthly payments. Variable interest rates, on the other hand, fluctuate based on market conditions or benchmark rates. While variable rates may start lower, they carry the risk of increasing over time, potentially impacting cash flow.

Factors Influencing Interest Rates

Several factors influence the interest rate on a commercial loan. These include the lender’s cost of funds, economic conditions, and the borrower’s creditworthiness. Market factors such as inflation, monetary policy, and competition among lenders also play a role. Additionally, the type of loan, its term length, and the level of risk associated with the borrower are key determinants.

How Interest Rates Affect Loan Costs

The interest rate on a commercial loan directly impacts its overall cost. Higher interest rates increase the total amount paid over the life of the loan, while lower rates reduce it. For businesses, this means that even a small difference in rates can lead to significant cost variations.

For example, a loan of $500,000 with an interest rate of 5% over 10 years results in total interest payments of approximately $137,500. However, if the rate increases to 6%, the total interest paid rises to about $166,000. Understanding these implications helps business owners make decisions that align with their financial strategies.

The Relationship Between Economic Conditions and Interest Rates

Economic conditions heavily influence interest rates. During periods of economic growth, central banks may raise rates to control inflation and stabilize the economy. Conversely, during economic downturns, rates are often lowered to encourage borrowing and stimulate growth.

For business owners, monitoring these trends is critical. Rising interest rates can increase borrowing costs, making it more expensive to finance projects or manage cash flow. On the other hand, falling rates present opportunities to secure cheaper loans or refinance existing debt at better terms.

Impact on Loan Types

Different types of commercial loans respond differently to changes in interest rates. Fixed-rate loans shield borrowers from market fluctuations, ensuring consistent payments regardless of economic changes. Variable-rate loans, however, are directly impacted by interest rate shifts. While they may offer lower initial rates, their long-term costs depend on how rates evolve over time.

Strategies to Mitigate Interest Rate Risks

Interest rate fluctuations can pose risks to businesses, particularly those with variable-rate loans. Adopting strategies to mitigate these risks is essential for maintaining financial stability. One approach is to lock in fixed rates during periods of low interest, ensuring predictable payments even if rates rise.

Another strategy is to evaluate refinancing options. Businesses with existing loans at higher rates can explore refinancing to take advantage of lower market rates. This can lead to substantial savings over the loan term. Additionally, maintaining a strong credit profile and reducing debt levels can improve eligibility for loans with favorable rates.

The Role of Creditworthiness

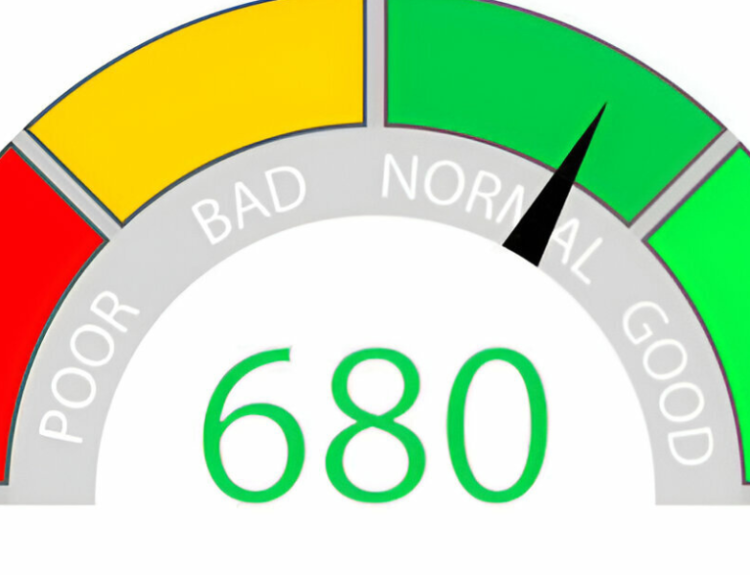

A business’s creditworthiness plays a significant role in determining the interest rate it qualifies for. Lenders assess factors such as credit scores, financial statements, and payment history to gauge risk. Businesses with strong financial profiles are more likely to secure lower rates, reducing their borrowing costs.

Building and maintaining good credit requires consistent financial management. This includes paying bills on time, managing debt effectively, and monitoring credit reports for errors. A strong credit profile not only enhances borrowing options but also strengthens overall financial resilience.

Evaluating the Long-Term Impact

When considering a commercial loan, it’s important to evaluate its long-term impact on your business. High interest rates can strain cash flow, limiting the ability to reinvest profits or manage unexpected expenses. Conversely, loans with low rates provide cost savings that can be redirected toward growth initiatives.

Conducting thorough financial analysis is essential for understanding the implications of a loan. This includes calculating total interest costs, assessing repayment capabilities, and considering potential market changes. Seeking advice from financial advisors or loan specialists can provide additional insights, ensuring that the loan aligns with your business objectives.

The Benefits of Timing and Market Awareness

Timing plays a crucial role in securing favorable interest rates. Monitoring economic conditions and understanding market cycles help businesses identify optimal moments to borrow. For example, securing a loan during periods of low interest rates minimizes costs and provides greater financial flexibility.

Market awareness also extends to lender comparisons. Different lenders offer varying rates and terms, making it essential to shop around. Comparing options allows businesses to find the best fit for their needs, balancing affordability with strategic goals.

Conclusion: Navigating Interest Rates with Confidence

Interest rates are a critical factor in commercial loans, influencing their cost, terms, and overall impact on a business’s financial health. Understanding how rates are determined and their effect on different loan types equips business owners with the knowledge needed to make informed decisions.

By evaluating economic trends, maintaining strong credit, and adopting strategies to mitigate rate risks, businesses can secure loans that support growth and stability. Whether locking in fixed rates for predictability or leveraging market opportunities to refinance, proactive management of interest rates ensures that your business remains well-positioned to achieve its goals. With careful planning and market awareness, navigating the complexities of interest rates becomes a powerful tool for long-term success.