When it comes to financing a business, the choice between short-term and long-term commercial loans can significantly impact your financial strategy. Each type of loan serves a specific purpose and aligns with different business needs, goals, and circumstances. Deciding which option is best for your business requires a thorough understanding of their features, advantages, and potential drawbacks. This guide provides an in-depth comparison to help you make an informed decision.

Understanding Short-Term Commercial Loans

Short-term commercial loans are designed to address immediate financial needs and are typically repaid within a period of one to three years. These loans are often used for purposes such as managing cash flow, covering unexpected expenses, or seizing time-sensitive opportunities. Due to their shorter repayment period, they tend to have higher interest rates compared to long-term loans.

One of the primary benefits of short-term loans is their speed. Lenders generally have a streamlined approval process, allowing businesses to access funds quickly. This makes them an ideal solution for urgent financial requirements, such as purchasing inventory during peak seasons or addressing temporary cash shortages.

However, the higher interest rates and shorter repayment periods can lead to higher monthly payments. Businesses must ensure they have sufficient cash flow to meet these obligations without straining their finances. Failing to do so can result in missed payments, penalties, and potential damage to credit ratings.

Exploring Long-Term Commercial Loans

Long-term commercial loans, on the other hand, are structured to provide funding over an extended period, often ranging from five to twenty years or more. These loans are commonly used for significant investments such as purchasing real estate, expanding operations, or acquiring large-scale equipment. With their longer repayment terms, these loans typically feature lower interest rates and more manageable monthly payments.

One of the key advantages of long-term loans is their ability to support substantial investments without immediate financial pressure. By spreading payments over a longer duration, businesses can allocate resources to other priorities while maintaining stability. This approach is particularly beneficial for projects with longer time horizons, where the returns may not materialize immediately.

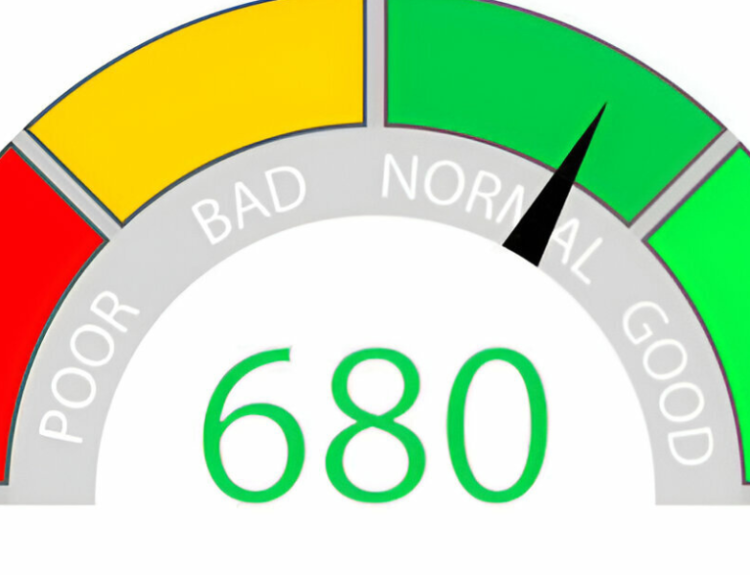

However, the lengthy repayment period also means that businesses pay more in interest over the life of the loan. Additionally, the approval process for long-term loans is often more rigorous, requiring detailed financial documentation and a strong credit profile. Businesses must also consider the risk of changes in market conditions or business performance over the extended term.

Key Factors to Consider

When deciding between short-term and long-term commercial loans, several factors come into play. The first is the purpose of the loan. Short-term loans are well-suited for addressing immediate needs or opportunities, while long-term loans are better for financing major investments that require extended repayment periods.

Your business’s cash flow is another critical consideration. Short-term loans demand higher monthly payments, making them more suitable for businesses with consistent and robust cash flow. Long-term loans, with their lower monthly obligations, provide greater flexibility for businesses with variable income or other financial commitments.

Interest rates also play a significant role in the decision-making process. While short-term loans often come with higher rates, the shorter repayment period can result in lower overall interest costs. Conversely, long-term loans offer lower rates but accrue more interest over time. Evaluating the total cost of the loan is essential to understanding its impact on your business’s finances.

Advantages and Disadvantages of Each Option

Short-term loans offer the advantage of quick access to funds, allowing businesses to respond to urgent needs or capitalize on opportunities. Their shorter repayment period also means that businesses are free from debt obligations sooner. However, the higher monthly payments and interest rates can strain cash flow, particularly for smaller businesses.

Long-term loans provide stability and lower monthly payments, making them a better fit for large-scale investments or businesses with long-term growth plans. The extended repayment period allows businesses to focus on their strategic goals without immediate financial pressure. However, the higher total interest cost and more stringent approval process can pose challenges.

Aligning the Loan Type with Your Business Goals

Choosing between short-term and long-term loans ultimately depends on your business’s goals and financial situation. If your priority is to address immediate needs, such as purchasing inventory or covering seasonal expenses, a short-term loan may be the right choice. For businesses seeking to invest in their future through property acquisition or major expansions, a long-term loan provides the necessary support.

It’s also important to consider your risk tolerance and market conditions. Short-term loans may expose businesses to higher financial risk due to their higher payments, while long-term loans involve extended exposure to interest rate fluctuations and economic uncertainties. Evaluating your industry’s stability and your business’s resilience can guide you toward the most suitable option.

How to Make an Informed Decision

To make an informed decision, start by assessing your financial health and cash flow. Understanding your revenue patterns, expenses, and existing obligations provides clarity on what your business can afford. Next, identify the specific purpose of the loan and the timeline for achieving your goals. Matching the loan type to your objectives ensures alignment with your broader business strategy.

Consulting with financial advisors or lenders can also provide valuable insights. These professionals can help you evaluate the pros and cons of each option, compare offers, and determine the best fit for your needs. Additionally, researching lenders and their loan products ensures you secure favorable terms and conditions.

Conclusion: Choosing the Right Loan for Your Business

The choice between short-term and long-term commercial loans is a critical decision that depends on your business’s unique circumstances, goals, and financial health. Each option offers distinct advantages and challenges, making it essential to carefully evaluate your needs and priorities.

By understanding the features of each loan type and aligning them with your objectives, you can secure financing that supports your business’s growth and stability. Whether you opt for the agility of a short-term loan or the stability of a long-term loan, a well-informed decision will set your business on the path to success. With thoughtful planning and expert guidance, you can navigate the complexities of commercial financing and achieve your goals with confidence.