Securing a commercial loan can be a transformative step for any business, providing the financial resources necessary to expand operations, purchase equipment, or manage cash flow. However, qualifying for a commercial loan is a meticulous process that requires preparation, organization, and an understanding of what lenders are looking for. This guide walks you through the steps to successfully qualify for a commercial loan and achieve your business goals.

Understanding the Loan Requirements

The first step in qualifying for a commercial loan is understanding the lender’s requirements. Every lender has specific criteria, but there are common elements they evaluate, including credit history, financial stability, business performance, and the purpose of the loan. Familiarizing yourself with these factors ensures that you approach the application process with realistic expectations.

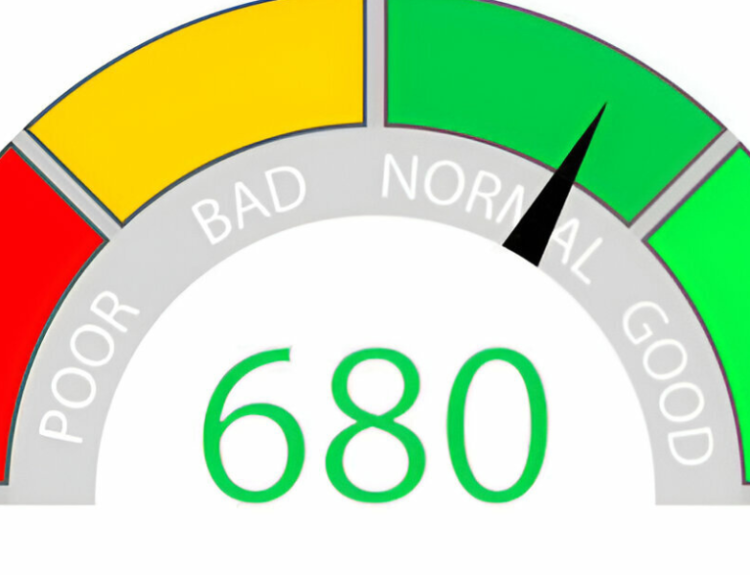

Creditworthiness is a critical factor in the approval process. Lenders assess both your personal and business credit scores to determine the risk of lending to you. A strong credit history reflects responsible financial behavior and increases your chances of approval. Additionally, lenders evaluate your debt-to-income ratio, ensuring that your current obligations do not exceed your financial capacity.

Preparing Financial Documentation

Comprehensive financial documentation is essential when applying for a commercial loan. Lenders require detailed records to assess the financial health and stability of your business. These documents typically include profit and loss statements, balance sheets, tax returns, and cash flow statements. Providing accurate and up-to-date records demonstrates your professionalism and readiness to handle the loan responsibly.

In addition to these documents, lenders may request a business plan outlining your objectives, strategies, and financial projections. A well-prepared business plan not only highlights your vision but also shows lenders how the loan will contribute to your business’s success. Including specific details about the use of funds and the expected return on investment strengthens your application.

Demonstrating Business Stability

Lenders prioritize businesses with a proven track record of stability and growth potential. To demonstrate stability, ensure that your financial records reflect consistent revenue, controlled expenses, and profitability over time. For newer businesses, showing a clear path to sustainability through projections and market research can help mitigate concerns about the lack of an established history.

Maintaining a stable operational environment is also important. Highlighting long-term contracts, recurring customers, or strong supplier relationships reassures lenders that your business has a solid foundation. Additionally, showcasing industry experience and leadership capabilities enhances your credibility and reinforces confidence in your ability to manage the loan effectively.

Identifying the Right Loan Type

Choosing the right type of commercial loan is a crucial part of the qualification process. Different loans serve different purposes, such as real estate acquisition, equipment financing, or working capital. Understanding which loan aligns with your business needs ensures that you present a focused and compelling application.

For example, if you’re seeking funds to purchase property, a commercial real estate loan may be the best fit. If your goal is to acquire machinery or technology, an equipment loan might be more appropriate. Clearly articulating the purpose of the loan and aligning it with the lender’s offerings demonstrates that you’ve done your research and are well-prepared.

Building Strong Relationships with Lenders

Establishing a relationship with your lender can significantly enhance your chances of qualifying for a commercial loan. Building trust and open communication allows you to better understand the lender’s expectations and tailor your application accordingly. Meeting with potential lenders to discuss your needs and seeking their advice creates a collaborative environment that benefits both parties.

For businesses with existing banking relationships, leveraging these connections can streamline the approval process. Lenders who are familiar with your business operations and financial history are more likely to consider your application favorably. If you’re approaching a new lender, taking the time to familiarize them with your business and its potential can make a positive impression.

Securing Collateral and Guarantees

Collateral is often a requirement for commercial loans, providing lenders with security in case of default. Collateral can include assets such as real estate, equipment, or inventory. Offering valuable and easily appraised collateral reduces the lender’s risk and increases your chances of approval.

Personal guarantees may also be required, especially for small businesses or startups. A personal guarantee demonstrates your commitment to repaying the loan and reassures the lender of your accountability. While offering collateral and guarantees involves risk, it also signals confidence in your ability to meet repayment obligations.

Addressing Potential Weaknesses

Before submitting your application, it’s important to address any potential weaknesses in your financial profile. Identifying areas such as low credit scores, inconsistent revenue, or insufficient collateral allows you to take proactive measures to improve your standing. For example, improving your credit score by paying down existing debts or resolving outstanding issues can make a significant difference in your application’s success.

If your business is relatively new or lacks a strong credit history, consider partnering with a co-signer or exploring alternative financing options. A co-signer with a solid financial profile can bolster your application and mitigate the lender’s concerns. Being transparent about any challenges and presenting solutions demonstrates your preparedness and reliability.

Submitting a Thorough and Compelling Application

The application itself is your opportunity to make a strong case for why the lender should approve your loan. Ensure that all required documentation is complete, accurate, and well-organized. A clear and concise presentation of your business’s financial health, goals, and repayment strategy highlights your professionalism and seriousness.

In your application, clearly outline how the loan will be used and the expected impact on your business. Whether it’s increasing revenue, reducing costs, or entering new markets, quantifying the benefits provides tangible evidence of the loan’s value. Lenders are more likely to approve applications that demonstrate a clear and achievable return on investment.

Understanding the Approval Process

After submitting your application, the lender will conduct a thorough review of your financial documents, business plan, and credit history. This process may involve multiple steps, including discussions with the lender, appraisals of collateral, and evaluations of your business’s market potential. Being responsive and cooperative during this phase helps maintain momentum and builds trust with the lender.

If additional information or clarifications are requested, provide them promptly to avoid delays. Maintaining open communication with the lender ensures that any concerns are addressed quickly and effectively, increasing the likelihood of a positive outcome.

Conclusion: Preparing for Success

Qualifying for a commercial loan requires preparation, strategic planning, and a clear understanding of lender expectations. By focusing on building financial stability, demonstrating business credibility, and aligning your application with the lender’s requirements, you can enhance your chances of securing the funding your business needs.

From understanding the loan requirements to presenting a compelling application, each step in the process plays a crucial role in achieving approval. By approaching the process with diligence and professionalism, you not only increase your likelihood of success but also position your business for growth and long-term financial health. With the right preparation and mindset, a commercial loan can become the foundation for realizing your business’s full potential.