Applying for a commercial loan is a significant step for any business, offering the potential to finance growth, manage cash flow, or invest in new opportunities. However, the application process can be complex, and certain mistakes can jeopardize your chances of approval or result in unfavorable loan terms. Understanding and avoiding these common pitfalls ensures a smoother process and better outcomes. This guide highlights the key mistakes to avoid when applying for a commercial loan and how to navigate the process effectively.

Failing to Prepare Adequate Documentation

One of the most common mistakes businesses make is failing to provide complete and accurate documentation. Lenders require detailed financial records, including balance sheets, income statements, tax returns, and cash flow statements, to assess your business’s financial health. Missing or incomplete documentation can delay the application process or lead to outright rejection.

The Importance of Being Organized

Proper organization of financial documents demonstrates professionalism and readiness. Businesses should ensure that all records are up-to-date, accurate, and easily accessible. Providing additional information, such as a comprehensive business plan or financial projections, strengthens your application by showing lenders how the loan will support your objectives.

Not Understanding Loan Requirements

Each lender has specific criteria for approving commercial loans, and not understanding these requirements is a frequent mistake. These criteria often include credit score thresholds, revenue levels, and collateral expectations. Applying for a loan without meeting these requirements wastes time and can negatively impact your credit profile.

Researching Lender Criteria

Before applying, thoroughly research potential lenders and their loan offerings. Understanding the qualifications they require helps you determine if your business aligns with their expectations. Consulting with the lender directly or reviewing their published guidelines ensures that your application is tailored to their criteria.

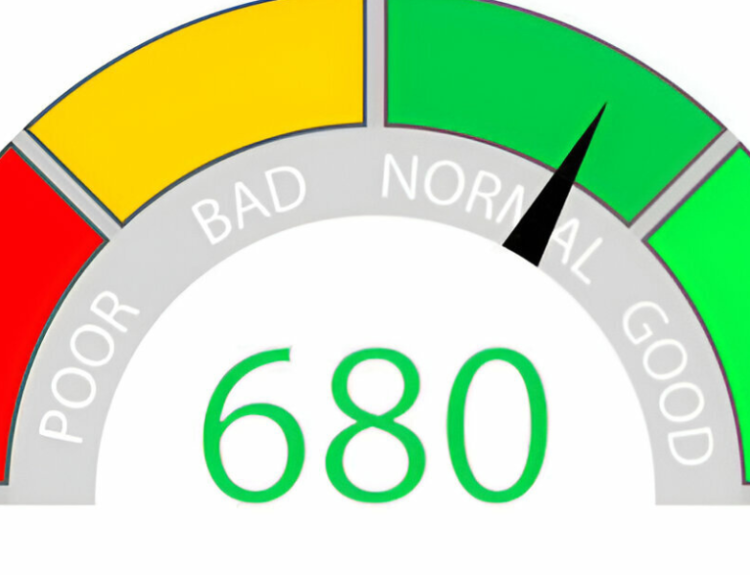

Overlooking the Impact of Credit Scores

A business’s credit score plays a crucial role in loan approval and terms. Some applicants underestimate the importance of credit scores or fail to address issues in their credit history before applying. A low credit score can lead to higher interest rates or rejection.

Steps to Improve Credit Scores

To improve your credit score, focus on paying bills on time, reducing existing debt, and correcting errors in your credit report. Starting this process well before applying for a loan allows sufficient time to see positive changes. Additionally, monitoring your credit regularly helps you stay informed and prepared.

Borrowing Without a Clear Purpose

Lenders want to understand how the loan will be used to benefit your business. Applying for a loan without a clear plan for its use can raise red flags and make it difficult for lenders to assess the viability of your request.

Defining Loan Objectives

Before applying, define the specific purpose of the loan, whether it’s for purchasing equipment, expanding operations, or managing cash flow. Providing a detailed explanation of how the funds will be used and the expected return on investment demonstrates that you’ve thought through your financial strategy.

Requesting an Unrealistic Loan Amount

Asking for too much or too little can harm your chances of approval. Lenders assess loan requests based on the financial needs of your business, and unrealistic amounts may indicate poor planning or a lack of understanding of your financial requirements.

Assessing Financial Needs

Carefully calculate the exact amount you need by evaluating the costs associated with your objectives. Avoid padding your request unnecessarily, as lenders will scrutinize the reasonableness of your loan amount. At the same time, ensure the amount is sufficient to cover your intended expenses fully.

Ignoring Loan Terms and Conditions

Another common mistake is focusing solely on the loan amount and interest rate while neglecting other terms and conditions. Elements such as repayment schedules, penalties for early repayment, and collateral requirements can significantly impact the overall cost and feasibility of the loan.

Reviewing the Fine Print

Take the time to review all aspects of the loan agreement thoroughly. If you’re unsure about any terms, consult with a financial advisor or attorney to ensure you understand the implications. Being well-informed helps you avoid unpleasant surprises later.

Applying to Multiple Lenders Simultaneously

While it’s important to compare lenders, applying to too many at once can hurt your credit score. Each application triggers a hard inquiry on your credit report, and multiple inquiries in a short period can lower your score.

Adopting a Targeted Approach

Focus on a few carefully selected lenders that align with your business’s needs and qualifications. Pre-qualification processes, where available, can give you an idea of your likelihood of approval without affecting your credit score.

Underestimating the Importance of Collateral

Many commercial loans require collateral to secure the loan, yet some applicants overlook this requirement or fail to provide sufficient assets. Lenders use collateral to reduce their risk, and the absence of adequate collateral can lead to rejection or less favorable terms.

Preparing Collateral Documentation

Identify assets that can be used as collateral, such as real estate, equipment, or accounts receivable. Ensure that the value of these assets is well-documented and aligns with the lender’s expectations. Presenting strong collateral enhances your application’s appeal.

Not Seeking Professional Advice

Navigating the complexities of commercial loans can be challenging, and attempting to handle the process alone often leads to mistakes. Failing to seek professional advice limits your ability to address potential issues and optimize your application.

The Value of Expert Guidance

Financial advisors, accountants, and loan specialists can provide valuable insights into the application process. They can help you identify the best loan options, prepare documentation, and negotiate terms. Investing in professional guidance often results in a smoother process and better outcomes.

Conclusion: Applying with Confidence

Avoiding common mistakes when applying for a commercial loan is essential for increasing your chances of approval and securing favorable terms. By preparing thoroughly, understanding lender requirements, and seeking professional advice, you can present a strong application that aligns with your business’s goals.

Whether you’re financing a new project or addressing operational needs, taking a strategic approach to the application process ensures that you get the most out of your commercial loan. With careful planning and attention to detail, you can navigate the complexities of borrowing and set your business on the path to growth and success.