Commercial loans play a crucial role in the growth and development of businesses, offering financial flexibility and resources to seize opportunities, overcome challenges, and achieve long-term goals. Whether you’re looking to expand operations, invest in new technology, or improve cash flow, commercial loans can provide the support needed to turn aspirations into reality. Understanding the benefits of these loans helps business owners make informed decisions and leverage their potential to drive success.

Access to Capital for Expansion

One of the primary benefits of commercial loans is their ability to provide immediate access to capital for expansion. Growing a business often requires significant investments, whether it’s opening a new location, increasing production capacity, or hiring additional staff. These endeavors typically come with high upfront costs that can strain a business’s cash flow. Commercial loans offer the financial resources needed to cover these expenses without compromising daily operations.

Accessing such capital ensures that businesses can scale effectively, meet increasing demand, and solidify their market presence. By financing expansion through a loan, business owners can also preserve their working capital, allowing them to address other operational needs simultaneously.

Flexibility in Loan Usage

Commercial loans are highly versatile, allowing businesses to allocate funds where they are most needed. Unlike some forms of financing that come with restrictions on how the money can be used, commercial loans offer greater flexibility. This means the funds can be directed toward diverse needs, such as purchasing equipment, upgrading technology, acquiring inventory, or even managing unexpected expenses.

This adaptability makes commercial loans particularly valuable in dynamic industries where priorities and opportunities can shift rapidly. Businesses can respond to changes in the market or invest in innovative strategies without being constrained by rigid financing terms. The ability to pivot and adapt is crucial for sustaining growth and maintaining a competitive edge.

Comparing Short-Term and Long-Term Commercial Loans

The benefits of commercial loans depend on their structure and terms. Short-term and long-term loans serve different purposes and offer distinct advantages. The table below highlights some of the key differences between the two:

| Loan Type | Ideal For | Key Advantages | Potential Drawbacks |

|---|---|---|---|

| Short-Term Commercial Loans | Addressing immediate financial needs | Quick access to funds, shorter repayment period | Higher monthly payments, higher interest rates |

| Long-Term Commercial Loans | Major investments and growth projects | Lower monthly payments, stability over time | Longer commitment, higher total interest paid |

Understanding these differences ensures businesses select the loan type that best aligns with their goals and financial capacity.

Improved Cash Flow Management

Maintaining healthy cash flow is essential for the sustainability of any business. Commercial loans help bridge gaps in cash flow by providing the necessary funds to cover operational costs during slow periods or when awaiting payment from clients. This ensures that the business can meet its obligations, such as payroll, rent, and supplier payments, without interruption.

Stabilizing cash flow through commercial loans also enables businesses to plan more effectively. When immediate financial concerns are addressed, owners can shift their focus to long-term strategies and operational improvements, laying the groundwork for sustainable growth.

Opportunity to Invest in Technology and Innovation

In today’s fast-paced business environment, staying competitive often requires investment in the latest technology and innovative solutions. Commercial loans enable businesses to adopt cutting-edge tools, systems, and equipment that can enhance efficiency, improve customer experience, and drive productivity.

For example, a manufacturing company might use a loan to purchase advanced machinery, reducing production costs and increasing output. A service-oriented business could invest in software solutions to streamline operations, improve client engagement, and strengthen their competitive position. These investments yield immediate operational benefits while positioning the business for long-term success.

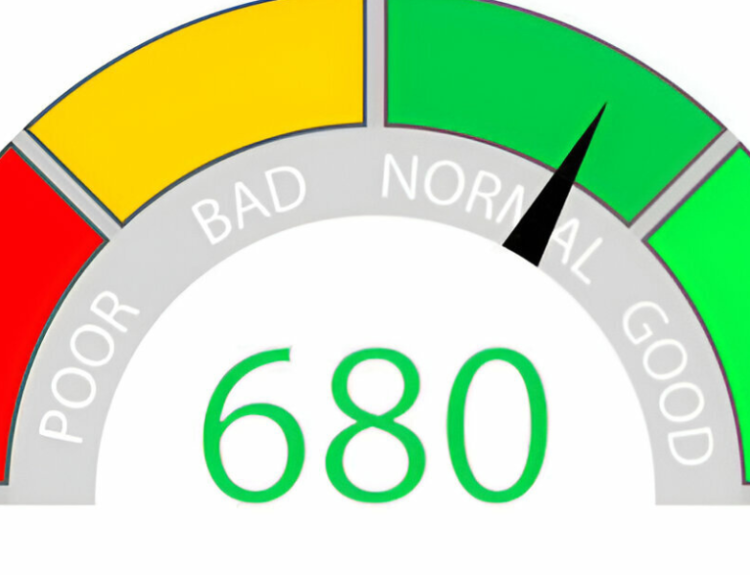

Building Business Credit

Taking out and responsibly managing a commercial loan can help establish and build business credit. A strong credit profile is essential for accessing better financing options in the future, including higher loan amounts and lower interest rates. By demonstrating reliability in repayment, businesses can cultivate a positive relationship with lenders, opening doors to additional opportunities for growth.

Building business credit also enhances the company’s financial reputation, which can be advantageous when negotiating with suppliers, securing partnerships, or attracting investors. It serves as a tangible indicator of the business’s stability and trustworthiness.

Tax Advantages

Another benefit of commercial loans is the potential for tax advantages. In many cases, the interest paid on business loans is tax-deductible, reducing the overall cost of borrowing. This can provide significant savings, especially for larger loans or those with extended repayment periods.

Understanding how to leverage these tax benefits requires careful financial planning and consultation with tax professionals. By optimizing the tax implications of a commercial loan, businesses can enhance their financial efficiency and reinvest savings into growth initiatives.

Opportunity for Strategic Investments

Commercial loans enable businesses to make strategic investments that might otherwise be out of reach. Whether it’s acquiring a competitor, entering a new market, or launching a major marketing campaign, these opportunities often require substantial funding. A well-structured commercial loan can provide the capital needed to execute these plans and achieve transformative growth.

Strategic investments often yield long-term benefits, such as increased market share, stronger brand recognition, and improved profitability. These gains set the stage for sustained success and greater resilience in the face of market challenges.

Fostering Business Resilience

Economic fluctuations and unforeseen events can create challenges for businesses, from supply chain disruptions to declines in demand. Commercial loans offer a financial safety net, allowing businesses to weather these periods of uncertainty while maintaining operations and protecting their workforce. This resilience ensures that temporary setbacks do not derail long-term goals.

By providing access to capital during difficult times, commercial loans empower businesses to adapt, innovate, and emerge stronger. This ability to navigate challenges and seize opportunities reinforces the company’s position in the market and enhances its reputation among stakeholders.

Tailored Solutions for Specific Needs

Lenders offering commercial loans often provide tailored solutions to meet the unique needs of different businesses. Whether it’s a short-term loan to address immediate cash flow issues or a long-term loan for significant investments, businesses can find financing options that align with their objectives and financial capabilities.

This customization allows business owners to optimize their borrowing experience, ensuring that loan terms, repayment schedules, and interest rates suit their specific circumstances. Working with a lender that understands your industry and goals can further enhance the benefits of a commercial loan.

Conclusion: Unlocking Potential with Commercial Loans

Commercial loans are a powerful financial tool that empowers businesses to grow, innovate, and thrive. By providing access to capital, flexibility in usage, and opportunities for strategic investments, these loans enable business owners to achieve their objectives and strengthen their competitive edge. From improving cash flow to adopting cutting-edge technology, the benefits of commercial loans are far-reaching and impactful.

When used responsibly and strategically, commercial loans can unlock a business’s full potential, fostering resilience and paving the way for long-term success. Whether you’re expanding operations, managing challenges, or pursuing ambitious goals, understanding and leveraging the advantages of commercial loans ensures that your business is well-equipped to navigate the complexities of today’s dynamic marketplace. With careful planning and the right financing partner, the possibilities for growth and achievement are endless.