Commercial loans are a cornerstone of business financing, offering the capital necessary to support startups and enable the expansion of established businesses. These loans provide essential financial resources for a wide range of needs, including purchasing equipment, hiring staff, and entering new markets. Understanding the role commercial loans play in business growth helps entrepreneurs and owners make informed decisions about leveraging this powerful tool.

Commercial Loans for Startups

For startups, accessing adequate funding is often one of the greatest challenges. New businesses typically lack the financial history or credit profile needed to attract investors or qualify for traditional financing. Commercial loans offer a lifeline, enabling startups to secure the capital necessary to launch their operations and establish a presence in the market.

Startups often use commercial loans to cover critical initial expenses, such as leasing office space, acquiring inventory, or purchasing equipment. These funds also help with marketing efforts to build brand awareness and attract customers. By bridging the gap between concept and execution, commercial loans empower entrepreneurs to turn their ideas into reality.

However, startups must approach commercial loans with caution. Lenders often require detailed business plans, financial projections, and sometimes collateral to mitigate the risks associated with lending to new ventures. Preparing thoroughly and seeking expert advice can improve the likelihood of securing favorable terms.

Commercial Loans for Expanding Businesses

For businesses looking to grow, commercial loans provide the financial backing to take operations to the next level. Expansion often involves significant investments, whether it’s opening additional locations, increasing production capacity, or entering new markets. Commercial loans offer the flexibility and resources needed to pursue these opportunities without disrupting daily operations.

In established businesses, commercial loans can also support innovation and modernization. Funds might be used to adopt new technologies, upgrade equipment, or enhance infrastructure. These improvements not only boost efficiency but also position the business for long-term competitiveness in a rapidly changing market.

How Commercial Loans Drive Growth

The role of commercial loans in driving business growth can be summarized through several key contributions. Below is a list of the ways these loans help businesses thrive:

- Providing Immediate Capital: Commercial loans give businesses the funds they need to seize opportunities or address urgent needs without delay. This financial agility is critical in competitive industries.

- Facilitating Expansion: By covering the costs of scaling operations, commercial loans enable businesses to grow their market share and enhance their revenue potential.

- Enhancing Cash Flow Management: Loans help businesses manage cash flow more effectively, ensuring that operational costs are met even during periods of reduced revenue or high expenditure.

- Promoting Innovation: Commercial loans allow businesses to invest in new technologies and systems, improving efficiency and driving innovation.

- Building Financial Credibility: Successfully managing a commercial loan helps businesses establish or improve their credit profile, paving the way for future financing opportunities.

Challenges of Commercial Loans

While commercial loans offer numerous advantages, they also come with challenges that businesses must consider. One of the primary hurdles is meeting the eligibility criteria set by lenders. Startups, in particular, may struggle to qualify due to limited financial history or insufficient collateral. Established businesses may face similar issues if their credit profiles are weak or their revenue streams are inconsistent.

Additionally, repayment terms and interest rates vary depending on the type of loan and the borrower’s financial stability. Businesses must ensure they have the capacity to meet monthly payments without compromising other financial obligations. Failure to do so can result in penalties, damage to credit, and, in severe cases, the loss of collateral.

It’s also important to weigh the total cost of borrowing. While loans provide immediate access to funds, the interest and fees associated with them can add up over time. Businesses should calculate the total repayment amount and compare it to the expected return on investment to determine whether the loan is financially viable.

Tips for Securing a Commercial Loan

Securing a commercial loan requires preparation and strategy. To improve your chances of approval and secure favorable terms, consider the following tips:

- Develop a Solid Business Plan: A well-documented business plan demonstrates your vision, market understanding, and revenue potential. Lenders view this as a key indicator of your ability to manage and grow the business.

- Organize Financial Documents: Ensure that all financial records, including tax returns, bank statements, and revenue projections, are accurate and up to date. This transparency reassures lenders about your financial stability.

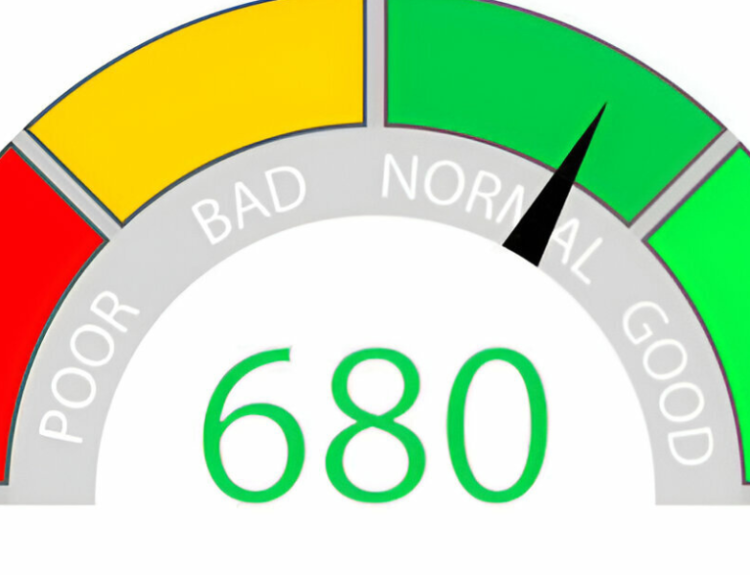

- Improve Your Credit Score: A strong credit score increases your chances of securing a loan with competitive terms. Pay off existing debts, address any errors on your credit report, and avoid taking on new liabilities before applying.

- Choose the Right Lender: Research different lenders and their loan products to find one that aligns with your business’s needs. Consider factors such as interest rates, repayment terms, and eligibility requirements.

- Seek Professional Guidance: Consulting with financial advisors or loan specialists can help you navigate the complexities of the application process and identify the best financing options for your situation.

The Long-Term Impact of Commercial Loans

When used strategically, commercial loans can have a transformative impact on a business. They provide the capital needed to execute growth strategies, enhance operational efficiency, and strengthen financial resilience. Over time, these benefits contribute to improved profitability, greater market presence, and a solid foundation for future growth.

For startups, successfully managing a commercial loan can establish credibility and set the stage for additional financing opportunities. For expanding businesses, loans enable scaling efforts that may not be possible with internal resources alone. In both cases, the judicious use of commercial loans helps businesses achieve their objectives and unlock their full potential.

Conclusion: A Strategic Tool for Success

Commercial loans play a vital role in the lifecycle of businesses, from supporting startups during their early stages to enabling established companies to pursue ambitious growth plans. By providing access to capital, fostering innovation, and enhancing financial stability, these loans empower businesses to navigate challenges and seize opportunities.

While commercial loans come with responsibilities and risks, careful planning and informed decision-making can mitigate potential downsides. For entrepreneurs and business owners, understanding the benefits and limitations of commercial loans is key to leveraging them effectively. With the right approach, these loans can be a powerful tool for achieving success and driving long-term growth.