Securing a commercial loan can be a pivotal step for businesses looking to expand, invest, or overcome financial challenges. However, lenders are meticulous in their evaluation process, requiring a strong business case to justify the loan request. Crafting a persuasive and well-supported case is essential to demonstrate your business’s viability and ability to repay the loan. This guide provides actionable tips to help you build a compelling business case and secure the financing your business needs.

Understand the Lender’s Perspective

The first step in building a strong business case is understanding what lenders are looking for. Lenders evaluate applications based on several key factors: creditworthiness, financial stability, repayment ability, and the proposed use of funds. Your business case should address these areas comprehensively, presenting your business as a low-risk and high-potential borrower.

To meet their expectations, consider how the loan aligns with your business goals and long-term strategy. Lenders want assurance that the funds will be used effectively to generate growth or stability, ultimately ensuring that repayments are made on time. Tailoring your business case to highlight these points increases your chances of approval.

Present Clear Financial Data

Financial transparency is crucial when applying for a commercial loan. Lenders need a clear understanding of your business’s financial health to assess its ability to meet repayment obligations. Providing detailed and accurate financial data is essential to instill confidence.

Include comprehensive financial statements, such as balance sheets, income statements, and cash flow statements, covering at least the past two years. Additionally, offer projections for the loan’s impact on your business, including expected revenue growth and expense reductions. Demonstrating how the loan will improve your financial performance strengthens your case.

Define the Purpose of the Loan

A vague or poorly defined loan purpose is one of the most common reasons applications are denied. Lenders need to understand precisely how the funds will be used and how they will benefit your business. Clearly articulating the purpose of the loan is critical.

Whether you’re seeking funds for equipment purchases, real estate acquisition, or operational expansion, outline the specifics in your business case. For example, explain how a new piece of machinery will increase production capacity or how acquiring additional space will allow you to serve more customers. Quantify the expected outcomes to provide tangible evidence of the loan’s value.

Highlight Your Business’s Strengths

Your business case should emphasize the strengths of your operation, demonstrating why your business is a reliable candidate for a loan. Focus on aspects such as market position, revenue trends, customer base, and industry expertise. Providing evidence of past successes and stability reassures lenders about your ability to manage the loan effectively.

For instance, highlight consistent revenue growth over the past few years, a loyal customer base, or contracts with reliable suppliers. If your business operates in a growing market or offers unique competitive advantages, include this information to showcase its potential for success.

Provide a Comprehensive Business Plan

A strong business plan is a cornerstone of any successful loan application. It demonstrates to lenders that you have a clear vision for your business and a well-thought-out strategy to achieve your goals. A detailed business plan also shows that you’ve considered potential risks and have contingency plans in place.

Include elements such as your business’s mission, market analysis, target audience, competitive landscape, and growth strategy. Ensure that your financial projections are realistic and supported by data. A robust business plan not only enhances your application but also serves as a valuable tool for guiding your operations.

Showcase Your Creditworthiness

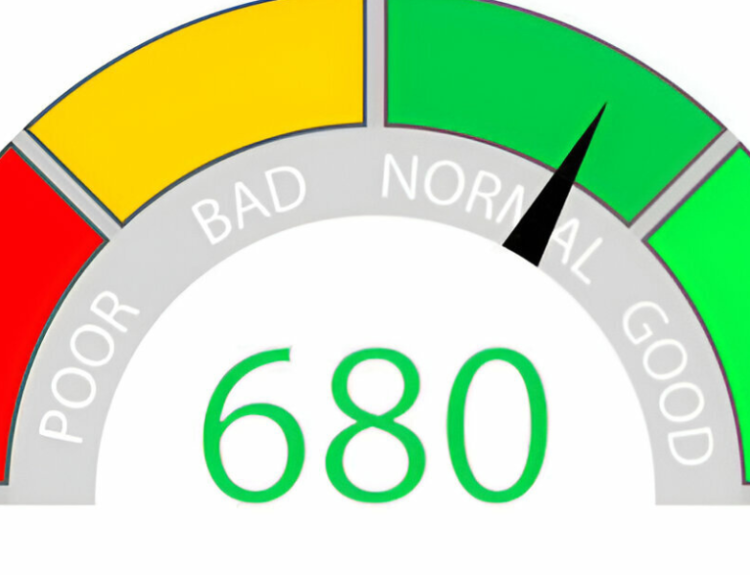

Your credit history is a key factor in a lender’s decision-making process. Both personal and business credit scores are assessed to evaluate your reliability as a borrower. Ensuring that your credit history is in good standing before applying for a loan is critical.

If your credit score needs improvement, take proactive steps to address issues, such as paying down existing debts or resolving errors on your credit report. Highlighting a strong credit profile in your business case reassures lenders of your ability to manage debt responsibly.

Demonstrate Your Ability to Repay

Lenders want assurance that you can repay the loan without compromising your business’s financial stability. Providing a clear repayment plan demonstrates your preparedness and commitment to fulfilling your obligations.

Calculate monthly repayment amounts and explain how your business will generate sufficient cash flow to cover these payments. Include scenarios that account for potential challenges, such as revenue fluctuations or unexpected expenses, and explain how you will address them. This level of preparation builds trust with lenders and reduces perceived risk.

Address Potential Risks

No business is without risks, and lenders appreciate applicants who acknowledge potential challenges and present strategies for mitigating them. Identifying risks demonstrates that you have a realistic understanding of your business environment and are prepared to navigate uncertainties.

For example, if your industry is subject to seasonal fluctuations, explain how you manage cash flow during off-peak periods. If market competition is a concern, outline your strategies for maintaining a competitive edge. Addressing risks proactively shows lenders that you are a thoughtful and capable business owner.

Build a Relationship with the Lender

Establishing a strong relationship with your lender can enhance your chances of approval. Lenders are more likely to work with businesses they trust and understand. Take the time to meet with potential lenders, discuss your needs, and seek their input on your application.

Building rapport allows you to present your business in a positive light and address any concerns the lender may have. Open communication also makes it easier to negotiate terms and find solutions that work for both parties.

Conclusion: Securing Success Through Preparation

Securing a commercial loan requires a well-prepared and persuasive business case that demonstrates your business’s strengths, financial stability, and repayment ability. By presenting clear financial data, defining the purpose of the loan, and addressing potential risks, you can build a compelling case that aligns with the lender’s expectations.

With careful planning, transparent communication, and a strategic approach, your business can access the financing needed to achieve its goals. A strong business case not only increases your chances of securing a loan but also lays the foundation for long-term success and growth. By putting in the effort to craft a robust application, you ensure that your business is positioned for a brighter future.