Maintaining healthy cash flow is essential for the success of any small business. From paying suppliers and employees to investing in growth opportunities, consistent liquidity ensures smooth operations and stability. However, many small businesses face cash flow challenges due to delayed payments, seasonal fluctuations, or unforeseen expenses. Commercial loans offer a valuable solution, providing the financial flexibility needed to address these issues and support long-term growth.

The Role of Commercial Loans in Cash Flow Management

Commercial loans are designed to provide businesses with immediate access to capital, which can be used to cover short-term needs or support strategic initiatives. For small businesses struggling with cash flow issues, these loans serve as a lifeline, bridging gaps between outgoing payments and incoming revenue.

Addressing Short-Term Cash Flow Gaps

Many small businesses experience delays in receiving payments from clients, creating short-term cash flow gaps that can disrupt operations. Commercial loans help cover critical expenses, such as payroll, rent, and supplier payments, ensuring that the business can continue to operate without interruption.

For example, a retailer preparing for the holiday season might need to purchase inventory well in advance of anticipated sales. A commercial loan allows them to secure the necessary stock without draining existing reserves, enabling them to meet customer demand and maximize revenue.

Providing Flexibility for Seasonal Businesses

Seasonal fluctuations can significantly impact cash flow for businesses that rely on peak periods for the majority of their income. Industries such as tourism, retail, and agriculture often face off-seasons where expenses outweigh revenue. Commercial loans provide the flexibility to manage these periods effectively.

Stabilizing Off-Season Operations

For seasonal businesses, maintaining operations during the off-season is critical to retaining staff, fulfilling commitments, and preparing for the next peak. Commercial loans offer the necessary funds to cover fixed costs, such as utilities and leases, during low-revenue months. This stability allows businesses to focus on long-term planning rather than short-term financial pressures.

In addition to providing immediate relief, commercial loans enable seasonal businesses to implement new strategies during quieter times. For instance, funds can be allocated to marketing efforts, staff training, or exploring diversification opportunities, ensuring that the business remains competitive throughout the year.

Supporting Growth Opportunities

While cash flow challenges are often associated with financial strain, they can also arise during periods of rapid growth. Expanding into new markets, launching a new product line, or upgrading equipment requires significant investment, which may exceed available resources. Commercial loans provide the capital needed to seize these opportunities without compromising day-to-day operations.

Financing Expansion Initiatives

Imagine a small manufacturing business experiencing a surge in demand. To meet growing orders, they may need to purchase additional machinery, hire more staff, or lease a larger facility. A commercial loan enables them to invest in these expansions while maintaining sufficient liquidity to handle operating expenses.

Expansion often requires more than just financial resources; it demands confidence in the ability to meet future obligations. With a well-structured commercial loan, businesses can pursue ambitious projects with the assurance that their cash flow remains intact.

Improving Supplier Relationships

Strong supplier relationships are a cornerstone of successful business operations. However, delayed payments can strain these partnerships and jeopardize the availability of essential goods or services. Commercial loans allow businesses to pay suppliers promptly, fostering trust and ensuring a steady supply chain.

Negotiating Better Terms

In addition to maintaining good relationships, timely payments can provide leverage when negotiating with suppliers. Businesses with reliable payment histories may secure discounts, extended payment terms, or priority access to limited resources. A commercial loan can facilitate these timely payments, ultimately reducing costs and strengthening supplier agreements.

Moreover, paying suppliers on time helps avoid disruptions in the supply chain, ensuring that businesses can meet customer expectations without delays. This reliability builds a strong reputation and enhances long-term growth prospects.

Consolidating Debt to Simplify Finances

For small businesses managing multiple debts, cash flow can become strained by juggling various repayment schedules and interest rates. Commercial loans can be used to consolidate existing debts into a single loan with more favorable terms, simplifying financial management and improving cash flow predictability.

Streamlining Repayments

Debt consolidation reduces the administrative burden of managing multiple loans, allowing business owners to focus on strategic priorities. By securing a commercial loan with lower interest rates or longer repayment terms, businesses can lower their monthly obligations, freeing up cash for other needs.

Additionally, simplifying debt management can lead to better financial planning. With fewer payments to track, businesses can allocate resources more efficiently and reduce the risk of missed deadlines or penalties.

Enhancing Financial Planning

Access to commercial loans also supports better financial planning. With additional funds available, businesses can implement more comprehensive strategies for managing expenses, investing in growth, and preparing for unexpected challenges.

Building Resilience

Unforeseen events, such as equipment breakdowns or economic downturns, can put a strain on cash flow. A commercial loan provides a financial buffer, allowing businesses to address emergencies without disrupting operations. This resilience not only helps businesses weather challenges but also positions them to thrive in a competitive environment.

Furthermore, having access to reliable funding encourages proactive decision-making. Businesses can take calculated risks, knowing they have the financial backing to recover or adapt if necessary.

Fostering Credit Growth

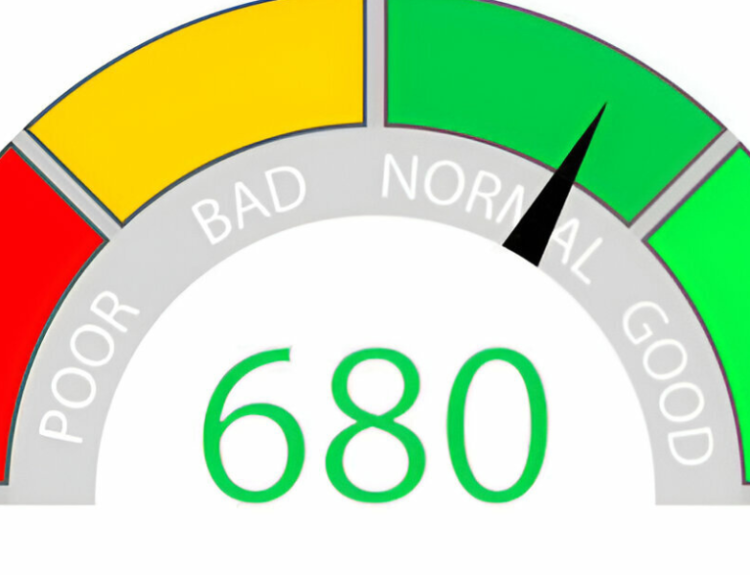

Using commercial loans responsibly can help small businesses build their credit profiles. A strong credit history is essential for securing future financing at favorable rates, enabling businesses to access larger loans or better terms as they grow.

Demonstrating Reliability

Repaying a commercial loan on time demonstrates financial discipline and reliability, improving the business’s reputation with lenders. Over time, this credibility can lead to greater borrowing capacity and more competitive financing options.

Additionally, a strong credit profile can attract investors and partners, further enhancing the business’s ability to grow and succeed. This expanded financial ecosystem creates opportunities for scaling operations and pursuing new markets.

Conclusion: A Strategic Tool for Cash Flow Management

Commercial loans are a powerful tool for small businesses, offering solutions to cash flow challenges while supporting growth and stability. Whether addressing short-term gaps, navigating seasonal fluctuations, or seizing expansion opportunities, these loans provide the flexibility and resources businesses need to thrive.

By understanding how commercial loans can improve cash flow, small business owners can make informed decisions about leveraging this financial resource. With careful planning, responsible management, and a clear focus on long-term goals, commercial loans can be a catalyst for success, ensuring that businesses are well-equipped to handle today’s challenges and tomorrow’s opportunities.